Tragis! Bos Yamaha Diserang Pisau oleh Putrinya

Kabar mengejutkan datang dari dunia otomotif. Seorang bos besar dari Yamaha, perusahaan motor terkenal asal Jepang, dilaporkan mengalami insiden tragis yang melibatkan putri kandungnya. Sang bos Yamaha diserang menggunakan pisau…

Tol Trans Sumatera: 1.100 Km Rampung Akhir 2024

Proyek Tol Trans Sumatera terus menunjukkan perkembangan signifikan dengan target penyelesaian sepanjang 1.100 km pada akhir 2024. Presiden Joko Widodo (Jokowi) telah menekankan pentingnya proyek ini dalam memperkuat konektivitas di…

BUMN sebagai> Penggerak Pertumbuhan Ekonomi Nasional

Badan Usaha Milik Negara (BUMN) memiliki peran strategis dalam perekonomian Indonesia. Sebagai entitas bisnis yang dimiliki dan dikelola oleh pemerintah, BUMN berfungsi sebagai motor penggerak utama dalam pembangunan ekonomi nasional.…

Kuliner Kaki Lima Malam di Jalan Veteran Balikpapan

Kuliner Kaki Lima Malam di Jalan Veteran Balikpapan Smoothie Bowl Estetik Buat Sarapan Instagramable – Sehat, Segar, Ala Kafe

Smoothie Bowl Estetik Buat Sarapan Instagramable – Sehat, Segar, Ala Kafe Kue Tradisional vs Kue Kekinian Mana yang Lebih Dicintai Gen Z? – Nostalgia atau Estetika?

Kue Tradisional vs Kue Kekinian Mana yang Lebih Dicintai Gen Z? – Nostalgia atau Estetika? Explore Tradisi Pukul Sapu di Leihitu Maluku Tengah: Ritual Adat Tua Toleransi

Explore Tradisi Pukul Sapu di Leihitu Maluku Tengah: Ritual Adat Tua Toleransi Pierre Kalulu: Bek Kalem yang Diam-Diam Jadi Senjata Rahasia Milan

Pierre Kalulu: Bek Kalem yang Diam-Diam Jadi Senjata Rahasia Milan Liburan ke Desa Wisata Majalengka Indah: Wisata Alam, Kopi, dan Edukasi Pertanian

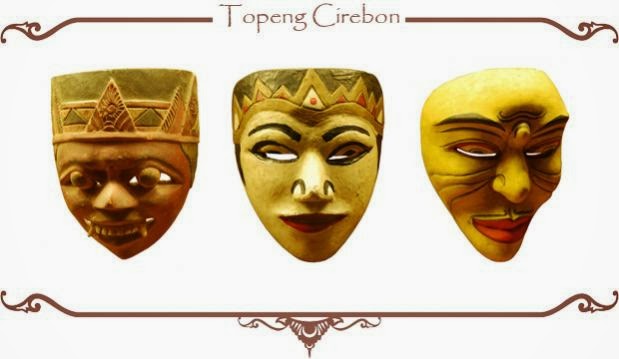

Liburan ke Desa Wisata Majalengka Indah: Wisata Alam, Kopi, dan Edukasi Pertanian Belajar Kerajinan Topeng Cirebon di Desa Slangit: Simbol Cerita Rakyat dan Wayang

Belajar Kerajinan Topeng Cirebon di Desa Slangit: Simbol Cerita Rakyat dan Wayang