Wisata Kuliner Dunia 10 Destinasi Makanan Legendaris yang Wajib Kamu Coba Sekali Seumur Hidup

Siapa bilang traveling cuma soal pemandangan dan foto-foto aesthetic? Bagi banyak orang, bagian paling seru dari perjalanan adalah menjelajahi kuliner dunia. Setiap negara punya cita rasa unik yang lahir dari…

Ide Jajanan Beku yang Bisa Disimpan Lama

Dunia kuliner selalu berkembang mengikuti kebutuhan zaman. Di tengah gaya hidup yang makin sibuk, banyak orang mencari makanan praktis yang bisa disimpan lama tanpa ribet. Dari sinilah tren jajanan beku…

Cara Menjadi Kreator Konten Virtual (VTuber) Pakai Teknologi Tracking Wajah Murah

Menjadi Kreator Konten Virtual sekarang bukan lagi mimpi mahal yang cuma bisa dijalanin studio besar. Teknologi sudah berubah cepat, dan dunia VTuber makin terbuka buat siapa saja. Kamu gak perlu…

Tips Menggunakan AI Buat Analisis Data Penjualan Toko Online Biar Strateginya Tepat

Punya toko online tapi ngerasa jualan stagnan? Bisa jadi masalahnya bukan di produk, tapi di cara baca data. Di sinilah Tips Menggunakan AI jadi krusial. Banyak pemilik toko online sebenarnya…

Rahasia Awet Muda Ala Lansia Pola Makan Sehat yang Nggak Ngebosenin

Siapa bilang awet muda cuma buat anak muda? Faktanya, banyak orang lanjut usia yang masih tampak segar, aktif, dan bersemangat setiap hari. Rahasianya bukan di skincare mahal atau suplemen aja,…

Peran Petronas dalam Menjaga Stabilitas Pasar Energi

Peran Petronas dalam menjaga stabilitas pasar energi menjadi semakin krusial di tengah ketidakpastian global yang terus meningkat. Pasar energi dunia saat ini dipengaruhi oleh banyak faktor, mulai dari fluktuasi harga…

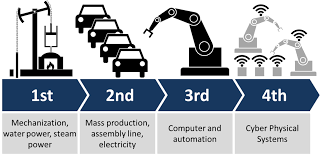

Sejarah Revolusi Industri 4.0 Dari Mesin Uap ke Era Kecerdasan Buatan

Kalau ngomongin sejarah Revolusi Industri 4.0, kita nggak bisa langsung lompat ke zaman digital dan AI tanpa paham akar historisnya.Segalanya dimulai dari Revolusi Industri 1.0 di abad ke-18, ketika manusia…

Tarot Harian dan Pengaruhnya terhadap Keputusan Sehari-hari

Di tengah rutinitas yang padat dan arus informasi yang tidak pernah berhenti, banyak orang merasa lelah mengambil keputusan setiap hari. Mulai dari urusan kerja, relasi, hingga pilihan kecil yang terlihat…

Rahasia Tetap Produktif Di Masa Tua Dengan Memiliki Bisnis Sampingan

Banyak orang membayangkan masa tua sebagai fase berhenti total dari aktivitas. Bangun pagi tanpa agenda, hari berlalu pelan, dan perlahan merasa tidak lagi dibutuhkan. Padahal kenyataannya, masa tua justru bisa…

Tips Memilih Dana Pensiun Lembaga Keuangan Atau DPLK Yang Terpercaya

Bicara soal masa tua, banyak orang langsung kepikiran pensiun tapi berhenti di niat. Salah satu alasannya karena bingung memilih Dana Pensiun yang benar-benar aman dan bisa dipercaya. Pilihan lembaga keuangan…

Wisata Kuliner Dunia 10 Destinasi Makanan Legendaris yang Wajib Kamu Coba Sekali Seumur Hidup

Wisata Kuliner Dunia 10 Destinasi Makanan Legendaris yang Wajib Kamu Coba Sekali Seumur Hidup Ide Jajanan Beku yang Bisa Disimpan Lama

Ide Jajanan Beku yang Bisa Disimpan Lama Cara Menjadi Kreator Konten Virtual (VTuber) Pakai Teknologi Tracking Wajah Murah

Cara Menjadi Kreator Konten Virtual (VTuber) Pakai Teknologi Tracking Wajah Murah Tips Menggunakan AI Buat Analisis Data Penjualan Toko Online Biar Strateginya Tepat

Tips Menggunakan AI Buat Analisis Data Penjualan Toko Online Biar Strateginya Tepat Rahasia Awet Muda Ala Lansia Pola Makan Sehat yang Nggak Ngebosenin

Rahasia Awet Muda Ala Lansia Pola Makan Sehat yang Nggak Ngebosenin Peran Petronas dalam Menjaga Stabilitas Pasar Energi

Peran Petronas dalam Menjaga Stabilitas Pasar Energi Sejarah Revolusi Industri 4.0 Dari Mesin Uap ke Era Kecerdasan Buatan

Sejarah Revolusi Industri 4.0 Dari Mesin Uap ke Era Kecerdasan Buatan Tarot Harian dan Pengaruhnya terhadap Keputusan Sehari-hari

Tarot Harian dan Pengaruhnya terhadap Keputusan Sehari-hari Rahasia Tetap Produktif Di Masa Tua Dengan Memiliki Bisnis Sampingan

Rahasia Tetap Produktif Di Masa Tua Dengan Memiliki Bisnis Sampingan Tips Memilih Dana Pensiun Lembaga Keuangan Atau DPLK Yang Terpercaya

Tips Memilih Dana Pensiun Lembaga Keuangan Atau DPLK Yang Terpercaya